Why Nvidia Fell from No. 1 to No. 3 in Market Value Behind Microsoft and Apple

Nvidia Falls from Top Spot

Key Points:

- Market Cap Drop: Nvidia's market value fell by over $220 billion, reducing its market cap from around $3.1 trillion to below Apple's $3.2 trillion and Microsoft's $3.3 trillion.

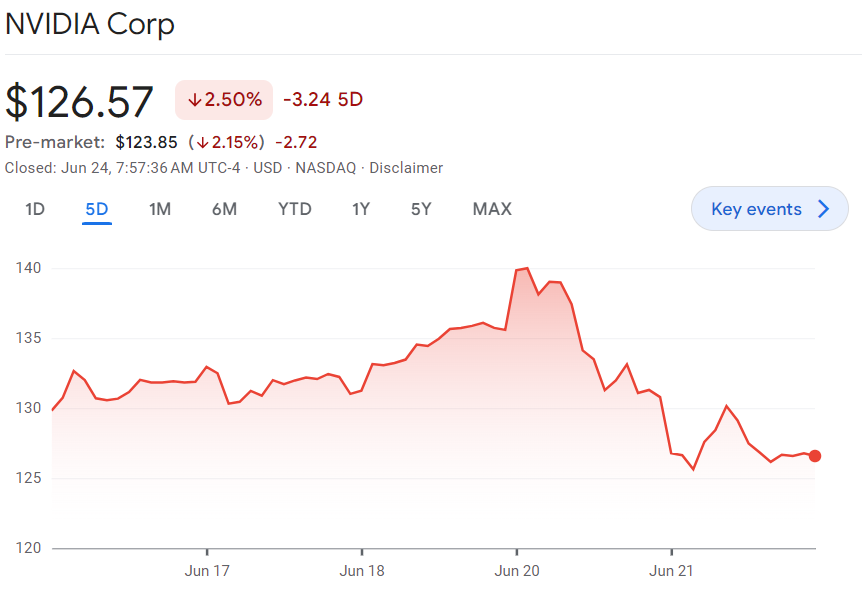

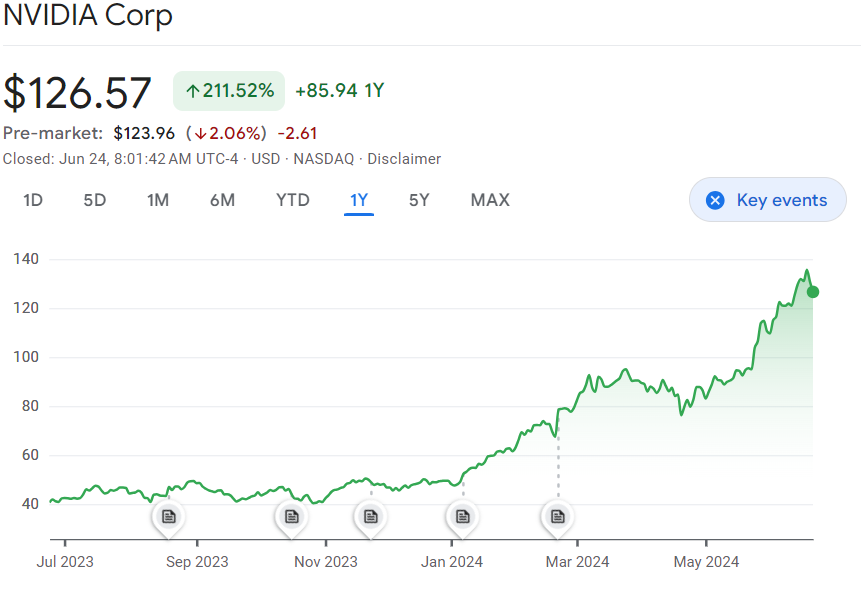

- Stock Performance: Nvidia's shares declined by 6.7% over two days following a nearly 200% increase over the past year.

- Triple Witching Effect: The decline coincided with a "triple witching" session, causing increased market volatility as various derivatives expired.

- AI Market Leadership: Nvidia holds an 88% share of the GPU market and reported $60.9 billion in annual revenue for fiscal year 2024.

- Analyst Opinions: Despite the recent drop, analysts remain bullish on Nvidia, with price targets set at $150 and $160, citing long-term growth potential due to AI demand.

Also read...

Nvidia’s Unstoppable Rise: A $3 Trillion Milestone and the Man Behind It

Detailed Analysis

Significant Drop in Stock Value:

- Nvidia Corp., a leading semiconductor giant, experienced a sharp decline in its stock value.

- Over just two days, Nvidia lost over $220 billion in market capitalization.

- This drop pushed Nvidia down from its brief position as the world's most valuable company.

- Nvidia's market cap was around $3.1 trillion but is now behind Apple ($3.2 trillion) and Microsoft ($3.3 trillion).

Rapid Ascent and Vulnerability:

- Nvidia's stock price had surged nearly 200% in the past year.

- This rapid rise made the stock particularly vulnerable to sudden drops.

- Analysts noted that there were no fundamental issues causing the selloff.

- Russ Mould from AJ Bell pointed out that such large companies can experience significant value changes due to market dynamics.

Impact of Triple Witching Session:

- A key factor in the decline was the "triple witching" session.

- This is a quarterly event where stock options, index options, and futures contracts expire simultaneously.

- Such events often lead to increased market volatility.

- Nvidia's stock was heavily impacted due to its substantial involvement in these contracts.

- Steve Sosnick of Interactive Brokers highlighted that Nvidia's significant weight in the Technology Select Sector Index, which was being rebalanced, contributed to the stock's turbulence.

Nvidia's Continued Dominance in AI and GPU Markets:

- Despite the recent drop, Nvidia remains a dominant force in the AI and GPU markets.

- The company holds an 88% market share in dedicated GPUs.

- Nvidia reported $60.9 billion in revenue for fiscal year 2024.

- Analysts from Bank of America and Melius Research remain bullish on Nvidia.

- Price targets are set at $150 and $160 respectively, reflecting confidence in its long-term growth potential.

Leadership and Influence:

- Nvidia's CEO, Jensen Huang, is a well-known figure in the tech industry.

- He is often compared to celebrities like Taylor Swift for his influence and popularity.

- Under his leadership, Nvidia has maintained its position at the forefront of AI technology.

Positive Long-Term Outlook:

- While Nvidia's stock faced a recent setback, the overall outlook remains positive.

- Analysts and investors are keeping a close watch on the company's performance.

- The broader AI market dynamics also contribute to a positive long-term outlook.

Stock Market Summary (as of 06/24/2024):

- Nvidia Corp (NVDA): 126.78 (-3.07%)

- S&P 500: -0.2%

- Nasdaq 100: -0.3%

- Dow Jones: Little changed

- MSCI World Index: -0.3%

Currencies:

- Bloomberg Dollar Spot Index: Little changed

- Euro: $1.0692

- British Pound: $1.2649

- Japanese Yen: 159.58 per dollar

Cryptocurrencies:

- Bitcoin: -1.2% to $64,301.01

- Ether: +0.4% to $3,538.53

Bonds:

- 10-year Treasuries Yield: 4.25%

- Germany’s 10-year Yield: 2.41%

- Britain’s 10-year Yield: 4.08%

Nvidia's recent market volatility highlights the complexities of stock market dynamics, particularly for high-growth tech companies. As always, investors should remain vigilant and consider both short-term fluctuations and long-term potential when evaluating their portfolios.

We have a dedicated team of three passionate individuals working tirelessly to bring you the news you need. Our team is led by Kaushalendra, the visionary owner and founder of Newshaq, who is committed to simplifying news delivery. Alongside Kaushalendra, we have two other team members who are equally dedicated to our mission of making news accessible and understandable for all.

Post Comment