Why has the NASDAQ fallen and future of NASDAQ ?

Tech-Heavy Nasdaq Hits Two-Week Low: Nvidia, ASML Crash 4-8% Amid Tighter US Trade Curbs Outlook

US tech stocks experienced a significant decline from all-time highs due to concerns over stricter US restrictions on global chip sales to China. Here's a detailed breakdown of the recent market events and their implications:

Key Points:

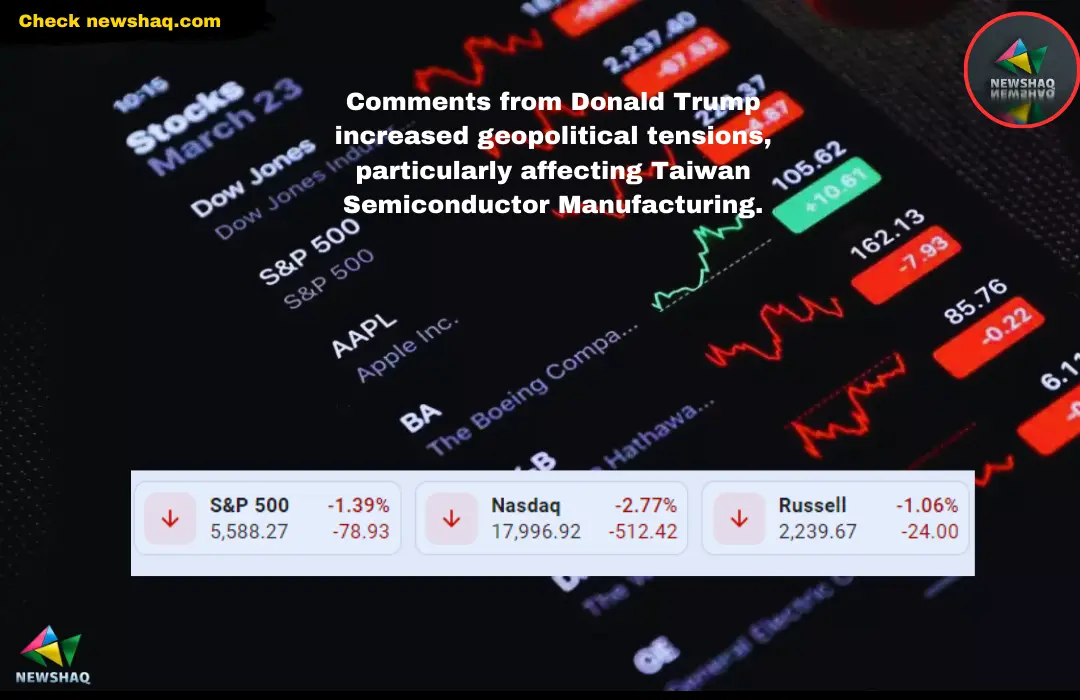

- Nasdaq Decline: The Nasdaq Composite fell nearly 2% to a two-week low.

- Major Losers:

- Nvidia Corp.: Dropped 4.3%

- ASML Holding NV: Sank 8%, even after reporting strong orders in Q2 2024.

- Advanced Micro Devices Inc. and Broadcom Inc.: Also tumbled.

- VanEck Semiconductor ETF: Lost 4%.

- Other Major Tech Stocks: Apple, Microsoft, Meta Platforms, and Tesla fell between 1.2% and 2.7%.

- US-Listed Shares of Taiwan Semiconductor Manufacturing: Shed 6.4% following comments from Donald Trump.

- Overall Market Impact:

- S&P 500 tech index declined by 2.7%.

- Energy sector saw a 1.3% gain.

- Global Market Reactions:

- Japan’s Nikkei 225: Declined more than 2%.

- South Korea’s Kospi: Dipped 1.27%.

- Hong Kong’s Hang Seng Index: Gained 0.33%.

- China’s CSI 300: Fell 0.52%.

Why has the Nasdaq Fallen?

- Stricter US Trade Curbs: Concerns over tougher restrictions on global chip sales to China led to a stock rout.

- Geopolitical Tensions: Comments from Donald Trump increased geopolitical tensions, particularly affecting Taiwan Semiconductor Manufacturing.

- Tech Sector Vulnerability: High valuations of tech stocks made them more susceptible to market corrections.

What Should Investors Do?

- Diversification: Spread investments across various asset classes and geographies to mitigate sector-specific risks.

- Focus on Strong Companies: Invest in companies with robust balance sheets and supply chain management capabilities.

- Proactive Risk Management: Adopt strategies to manage risks effectively, considering the potential long-term impacts on corporate earnings in tech-heavy sectors.

Detailed Analysis:

US tech stocks fell from their peak levels due to concerns over tighter US restrictions on global chip sales to China. The tech-heavy Nasdaq Composite slumped nearly 2%, hitting a two-week low. The S&P 500 also faced losses, with major chip and tech stocks being pressured by potential sanctions on companies providing advanced semiconductor technology to China.

The VanEck Semiconductor exchange-traded fund, valued at $24 billion, lost 4%. Nvidia Corp., a major player in AI-chipmaking, saw a 4.3% decline. ASML Holding NV, despite reporting strong Q2 orders, dropped 8%. Other semiconductor giants like Advanced Micro Devices Inc. and Broadcom Inc. also faced significant losses.

US-listed shares of Taiwan Semiconductor Manufacturing fell by 6.4% after Donald Trump’s comments suggesting Taiwan should pay the US for its defense. Major chip stocks, including Marvell Technology, Broadcom, Qualcomm, Micron Technology, and Arm Holdings, all declined by over 5%.

The “Magnificent Seven” megacap stocks—Apple, Microsoft, Meta Platforms, and Tesla—experienced drops ranging from 1.2% to 2.7%. The S&P 500 tech index led sectoral losses with a 2.7% decline, while the energy sector emerged as the top gainer, up 1.3%.

In global markets, Asia-Pacific indices tumbled as chip-related stocks fell. Japan’s Nikkei 225 dropped more than 2%, and South Korea’s Kospi dipped 1.27%. However, Hong Kong’s Hang Seng Index managed a slight gain of 0.33%, while China’s CSI 300 fell by 0.52%.

Summary

The Nasdaq Composite recently hit a two-week low due to concerns over tighter US trade curbs on chip sales to China. Major tech stocks, including Nvidia and ASML, experienced significant declines. Investors are advised to diversify their portfolios and focus on companies with strong fundamentals to mitigate risks amid market turbulence.

By providing timely updates and detailed analysis, we aim to keep our readers informed and help them make well-informed investment decisions.

We have a dedicated team of three passionate individuals working tirelessly to bring you the news you need. Our team is led by Kaushalendra, the visionary owner and founder of Newshaq, who is committed to simplifying news delivery. Alongside Kaushalendra, we have two other team members who are equally dedicated to our mission of making news accessible and understandable for all.

Post Comment