US Fed Meeting: Eyes on Tech & Market Reactions as Tensions Rise

US Fed Holds Key Rates Steady at 5.25-5.50% for 8th Straight Meeting

The US Federal Reserve, under the leadership of Jerome Powell, has once again decided to keep its benchmark interest rates unchanged, maintaining them between 5.25% and 5.50% for the eighth consecutive meeting. This decision aligns with expectations and reflects the Fed's cautious approach as it continues to monitor inflation and economic conditions.

Key Highlights:

- Interest Rates Unchanged: The Fed's decision to keep interest rates steady is part of its ongoing efforts to control inflation while ensuring economic stability.

- Inflation Fight: The Fed acknowledged making "some further progress" in its battle against inflation but remains "attentive to the risks to both sides of its dual mandate."

- Labor Market and Inflation: Recent data shows that inflation is gradually easing, with the labor market beginning to balance. The personal consumption expenditures (PCE) price index, a key inflation gauge, increased by just 0.1% in June, indicating cooling price pressures.

- US Treasury Yields: Yields on US Treasury bonds have been fluctuating, with economists noting that there might be limited room for further cuts in the near term. The front end of the curve is already pricing in seven rate cuts by the end of 2025.

- Economic Outlook: Despite the unchanged rates, there are signs that the US economy is cooling, as seen in slowing consumer spending and a softer labor market. Fitch Ratings predicts that the Fed may implement two rate cuts in 2024, possibly in September and December.

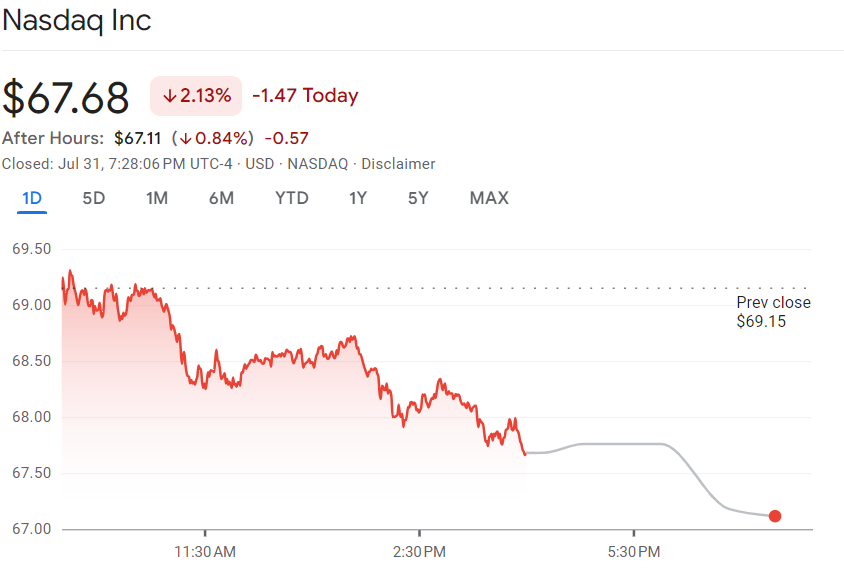

Market Reactions:

Before the Fed’s announcement, the stock market saw significant activity. The Nasdaq and the S&P 500 experienced gains driven by a rally in tech stocks, with Advanced Micro Devices (AMD) and Nvidia leading the charge.

In Europe, equities also rose, fueled by a rally in semiconductor stocks. The Stoxx Europe 600 closed 0.8% higher, marking a monthly gain of 1.3%.

Gold prices saw their best monthly performance since March, rising 0.7% to $2,424.29 per ounce. Meanwhile, oil prices rebounded by more than 2% due to heightened geopolitical tensions following the killing of a Hamas leader in Iran.

Geopolitical Impact:

- US-China Tensions: The US is reportedly considering new restrictions on China’s access to AI memory chips, which could further escalate the ongoing tech rivalry between the two superpowers. This move could affect major chipmakers like Micron Technology and South Korea’s SK Hynix and Samsung Electronics.

- Middle East Tensions: The killing of a Hamas leader in Iran has increased geopolitical risks, contributing to the recent spike in oil prices.

Expert Opinions:

Radhika Rao, Executive Director and Senior Economist at DBS Bank, highlighted that the current market conditions might not justify further rate cuts. However, a dovish Fed could trigger another rally in US Treasury yields.

Analysts and traders are closely watching for any hints from the Fed regarding future rate cuts, particularly in September. The Fed's cautious approach is aimed at avoiding any premature moves that could reignite inflation.

Looking Ahead:

- Potential Rate Cuts: While the Fed held rates steady in this meeting, there is speculation about potential rate cuts later in the year. September is viewed as a possible timeframe for the first cut, with market participants hoping for clarity in the coming months.

- Economic Indicators: The Fed will continue to monitor key economic indicators, including inflation, GDP growth, and labor market conditions, to inform its future decisions.

Stay tuned to newshaq.com for the latest updates and in-depth analysis of the US Federal Reserve's policies and their impact on global markets.

We have a dedicated team of three passionate individuals working tirelessly to bring you the news you need. Our team is led by Kaushalendra, the visionary owner and founder of Newshaq, who is committed to simplifying news delivery. Alongside Kaushalendra, we have two other team members who are equally dedicated to our mission of making news accessible and understandable for all.

Post Comment